Robert Solow

This book is set of six lectures on the Theory Of Endogenous Growth given by Robert Solow at the University Of Siena in Tuscany, Italy in 1992. These lectures are extremely excellent: clear, perceptive and brilliant. Anyone who reads them will have a better idea what is right and (more importantly) what is wrong with this area of economics. Solow has a brilliant technical command of his subject, a philosophical wisdom about his profession and - it must be said - a brilliant way with words. I would strongly recommend this book to anyone, even if the only relationship with neoclassical economics they desire is spitting on its grave. The only caveat is that the lectures make fairly steep assumptions about the reader's ability to read math.

So, what is the Theory Of Endogenous Growth? To answer this, let's start with a simpler question - "What is Growth Theory?". To answer this, we will (somewhat artificially) divide all the thoughts and models of the broad economy into two parts: sickness and health. The theory of depressions & recessions, of inflations and deflations, of coordination failures throughout supply chains, etc. etc. etc. are the theories of sickness. One can study the sources of sickness - monetary & fiscal policy mistakes, movements of aggregate demand, unpredictable policies, sheer complexity of the economic system, unforeseeable economic shocks, etc..

Roy Harrod

This list of problems seem formidable obstacles to any economy, like mountains of disease. Back in the late 30's and yearly 40's, economist Roy Harrod formalized these ideas and found two major sources of illness in a (closed, growing) economy. These sources are: 1) the difference between expected investment and actual savings and 2) the difference between "natural" and actual growth rates. In 1956, Solow demonstrated that these two sources were actually one - if expected investment were always equal to actual savings (by some miracle), then the actual growth rate would also be the natural growth rate. By abstracting away from money and the business cycle, Solow was able to collapse all of the old theory into a few simple equations - simple enough to be checked against the data. The only problem is, of course, the assumptions of the theory are quite wrong...

Following Solow's ideas like greyhounds after a lure, the neoclassical theorists of growth - which is now Growth Theory tout court - abstracts from the business cycle and treats so-called "long run growth" (spooky scary scare-quotes roam across the land...). As a stylized fact, this growth is exponential, which simplifies analysis. All we really care about is the relations between various rates.

There are two unpleasant things about Solow's model.

One I've already outlined - it doesn't even talk about recessions, depressions and other moments of ill health. Why make the heroic assumption that all is right in the Keynesio-Monetarist side of the economy? Perhaps it Solow's natural Roosevelt-Truman WWII American optimism against Harrod's decline of the British Empire pessimism. Perhaps it was because Solow was just entering his 30s and Harrod was leaving his 30s. Whatever the cause, we will leave this alone.

The second is that the theory describes relations between the rates but doesn't give any reason that the rates should be one number and not another. No matter what stripe of economist you are, the natural growth rate of the economy should be given by something in the economy, not just postulated and "measured" (I hope you find these scare-quotes frightening!). When a parameter is given as part of the structure of a model it is called 'exogenous'. If a parameter is a exogenous to a model, then that model says nothing of interest about that parameter. Yet the growth rate matters to the central banker or politician as well - in the unemployment rate goes up or down how do we know it's because of a deep, permanent shift in the economy as opposed to a shallow slide that needs to be corrected so that it doesn't become an avalanche?

This second problem, of taking growth rate as a prediction instead of a predictor, would satisfy more souls. When a parameter is derived from it is called 'endogenous'. Therefore, this is the problem of 'Endogenous Growth'.

Trevor Swan

The Siena lectures begin with a lecture on merely Exogenous Growth Theory. The first chapter is a sort of refresher course with some subtle points that Solow will use in the other lectures. Solow exposits the now traditional Neoclassical Growth Theory from two perspectives: a "maximizing" perspective which emphasizes its Neoclassical & Theoretical aspects and a "behavioristic" perspective which emphasizes its Keynesian & Positive aspects

In my earlier post, I talked about a textbook which emphasized the "behavioristic" Keynesian & Positive approach. The "behavioristic" approach has the disadvantage that some of the steps are purposefully arbitrary. It cannot really be extended, since every possible function is (in theory) allowed. Supposedly, we just filch a consumption function and check against the data. In reality, we take the consumption function from the other approach.

This arbitrariness is reduced very slightly in the "maximizing" Neoclassical & Theoretical approach. In this approach, the consumption function is derived by a bit of calculus from a utility function (a function which tells how satisfied the household is with a particular path of consumption over time) - which is itself arbitrary. Solow has some fun teasing the utility function ("a peasant household ... which goes on forever, with consistent preferences"). The only purely scientific advantage of the "maximizing" approach is that it suggests (to some) ways to extend to new theoretical vistae. Solow is forced to include the "maximizing" approach because such a vista is the goal of "Endogenous Growth Theory".

Solow concludes his exposition of Neoclassical Growth Theory with a brief summary. Consumption per head grows at exactly the rate of labor augmenting technological progress (given by the gods and the kings). The stock of capital grows at the rate of labor augmenting technological progress plus the rate of population growth (given by the same folk). Output grows at the same rate.

Robert Lucas

Solow begins the development of Endogenous Growth Theory with a bit of a trick. He does not show Lucas's 1988 Endogenous Growth Theory model. Instead, he modifies the utility function (which, remember, is arbitrary) of that model slightly (perhaps Lucas would prefer "slightly" in scare-quotes). In Lucas's model, every moment not spent working is spent learning. That rate of learning feeds forward into the growth rate. The growth rate is now endogenous, determined by this learning rate. In this new Solow-Lucas model, consumers can enjoy leisure.

The result is illustratively disastrous. No matter how small the enjoyment rate of leisure is, the consumer will always take enough leisure to cancel out any endogenity of the growth. The model is not continuous in the parameter that gives the rate at which one enjoys leisure. At zero exactly, there is endogenous growth, away from zero - no matter how slightly - only exogenous growth is seen.

Solow demonstrates this very carefully and with great insight. But this result would not be shocking to anyone with mathematical ability. There is no reason to assume these extrema are continuous in every parameter. It doesn't take much thought to notice that fastest route between two points is teleportation. But it does spell grave difficulties for any supposed theory of endogenous growth. Without continuity one cannot have approximability. Even drunken man can approximate a straight line home but what does it even mean to approximate teleportation home? Nothing. This is destructive to the positive point of view. If you believe in the Lucas's 1988 Endogenous Growth Theory model, it no longer makes any sense whatsoever to think of the assumptions as maybe right-ish and test them out, one must be correct in a very divine way about the Solow Leisure Parameter being zero.

Paul Romer

In the third through fifth lecture, Solow examines and dissects various other endogenous growth models. This includes a Paul Romer model in which increasing varieties of capital goods determine growth, a Grossman-Helpman model where increasing knowledge allows one to make more and a greater variety of goods and an Aghion-Howitt model where innovations arrive randomly. All of these introduce further knife-edge assumptions to the stock neoclassical assumptions. Romer's paper is dependent on a particular institutional structure, Grossman-Helpma's paper demands a very particular function for the growth of knowledge on pain of producing infinite goods in finite time, the Aghion-Howitt model is contains many extremely arbitrary and unmeasurable elements - including the painful fact that endogenity is assumed rather than being a natural feature of the model.

Solow states and implies that these difficulties are representative of the endogenous growth theoretical literature. As far as I am aware, this is still true.

Robert Summers

In the sixth and final chapter, Solow looks over what was then the latest growth data. A cliche among investors states "Information is worth money, so macro data is free.". While not quite true, it isn't more misleading than a cliche should be. More over, since the endogenous growth models are related in very complex and non-continuous ways to exogenous growth models and each other, even with heroic assumptions the data do not distinguish among the models very well. It is my understanding that while the quantity and quality of data have improved significantly. However, this cannot fix the mathematical difficulties around discontinuity.

Robert Solow

This book has much to recommend it as an introduction and critique of the methods & minds within modern neoclassical growth theory. I feel that the real message of this book is that if we really want to understand growth, what we need is an empirically grounded micro-macro understanding of the actual process of innovation as it really occurs rather than piling arbitrary assumption on heroic assumption. Many - such as the philosopher Karl Popper - believe there is no scientific pattern to this across countries or over time. If so, a lot of high powered economists are chasing waterfalls...

In the song "Romulus", Sufjan Stevens describes (of a gift VCR from his grandfather) how he and his sibs would furtively "watched it all night". Result? "We grew up anyway." Robert Solow's growth theory is based on a similar observation. He doesn't try to pick apart Roy Harrod's reasoning around divergent investment and savings; instead, he points out that, whatever the short-term coordination problems, a developed economy behaves long-term as if investment = savings. That one observation made Harrod's approach to "dynamics" seem as silly as Zeno's paradox - and it transformed macroeconomics.

ReplyDeleteIn developed economies, growth happens - that's pretty much the theory. Solow was always aware that he had abstracted away from significant problems; hence his career-long search to find an economics of the "middle term", i.e., a dynamic system that included fluctuations. Business cycle theory went in a different direction, of course, and I think that is part of the background of these Sienna lectures. Solow shows the problems that stem from introducing infinitely-lived, rational expectations-type individual into growth theories (as had been done with business cycle theory). Attempts to endogenize technical change in this way end up making assumptions just as arbitrary than exogenously assigning an empirically-suggested value to the growth rate of technological progress. To this one might add the point that the endogenous theories tended to lack generality; they incorporated specific, often-ingenious theories of one type of innovation - but productivity improvement happens in many way across all factors. Was the Solow Model too abstract? perhaps, but the endogenous theories weren't abstract enough to describe a whole economy.

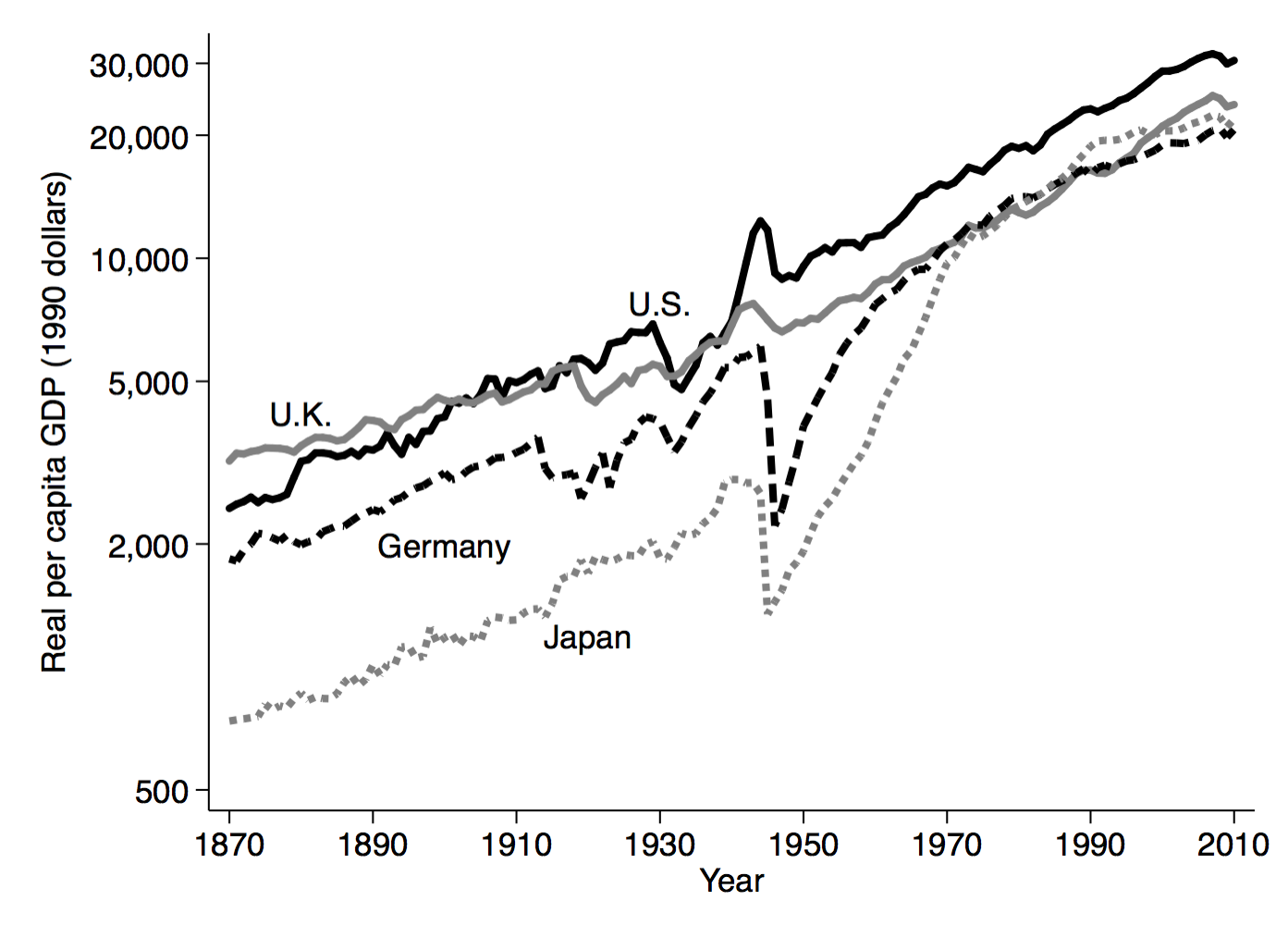

The biggest problem with Solow's theory - and he mentions this in the Sienna lectures - is that people try to make it more than it is. It doesn't offer any explanation for why some countries are rich, others poor. People have drawn a "convergence hypothesis" from the model's mathematical properties - it doesn't work very well. The Solow Model is more a theory of how rich countries chug along, how they are pretty much alike except for that tantalizing differentiator of productivity growth.

Thanks for the post and for the opportunity to sort out my own thinking. I love this book- but you point out correctly that it is very challenging mathematically. Solow's 1956 and 1957 papers (or Swan's 1956 paper) are actually a better "intro" to the model. Jones and Vollrath's "Introduction to Economic Growth" textbook does a good job of covering the major extensions. Then one is equipped for the trench warfare of the Sienna lectures.