Niels Abel said about Carl Gauss "He is like a fox who effaces his tracks in the sand with his tail.". The same can be said of Italian economist Piero Sraffa, whose big book on the theory of production is 112 pages long. Though published in 1960, there is plenty of evidence that Sraffa had the basic ideas written out in 1928. This 32 year gestation period was mostly a time of intense "taking out", resulting in book that is like a glittering diamond with aperiodic facets.

Piero Sraffa, John Maynard Keynes and Dennis Robertson

The most important and most annoying thing about Production Of Commodities By Means Of Commodities: A Prelude To A Critique Of Economic Theory is that it is a ... well, prelude to a critique of economic theory. There are huge, yawning gaps that presumably would have been covered in the actual critique had Sraffa's perfectionism not prevented him from publishing it. This results in a book that often works by innuendo and carefully laid traps rather than by overt calculation.

Obviously, I can't approach Sraffa's level of brilliance in a blog post, but here we go critiquing anyway.

Philip Wicksteed

By "Economic Theory", Sraffa means the marginal method of Wicksteed, Irving Fisher and so forth. Unfortunately, it isn't easy to actually say exactly what this theory means, especially in equilibrium where all the forces balance. Perhaps the essential thing is captured in the famous quote from Richard Whately: "It is not that pearls fetch a high price because men have dived for them; but on the contrary, men dive for them because they fetch a high price.".

What could this possibly mean? The price of a commodity is just the balance of supply and demand for that commodity - whether it is a "final good" (like cake - a good whose demand is strictly for its own consumption) or mere "factor" (like flour - a good whose demand is strictly for making other goods, like cake, to consume) or something in between (like water - which is both consumed for its own sake and used to make cake). The vaunted and so-called "supply" is just the flour manufacturer's demand (for, say, money). "Equilibrium" is the balance of the demands of everyone's goods against everyone else's demand for everyone's goods.

Production theory, while not simple (due to involving demands across time), isn't special - just because the price of flour is determined by the demand for cake tomorrow doesn't mean it isn't set by the balance manufacturer's demand and consumer's demand.

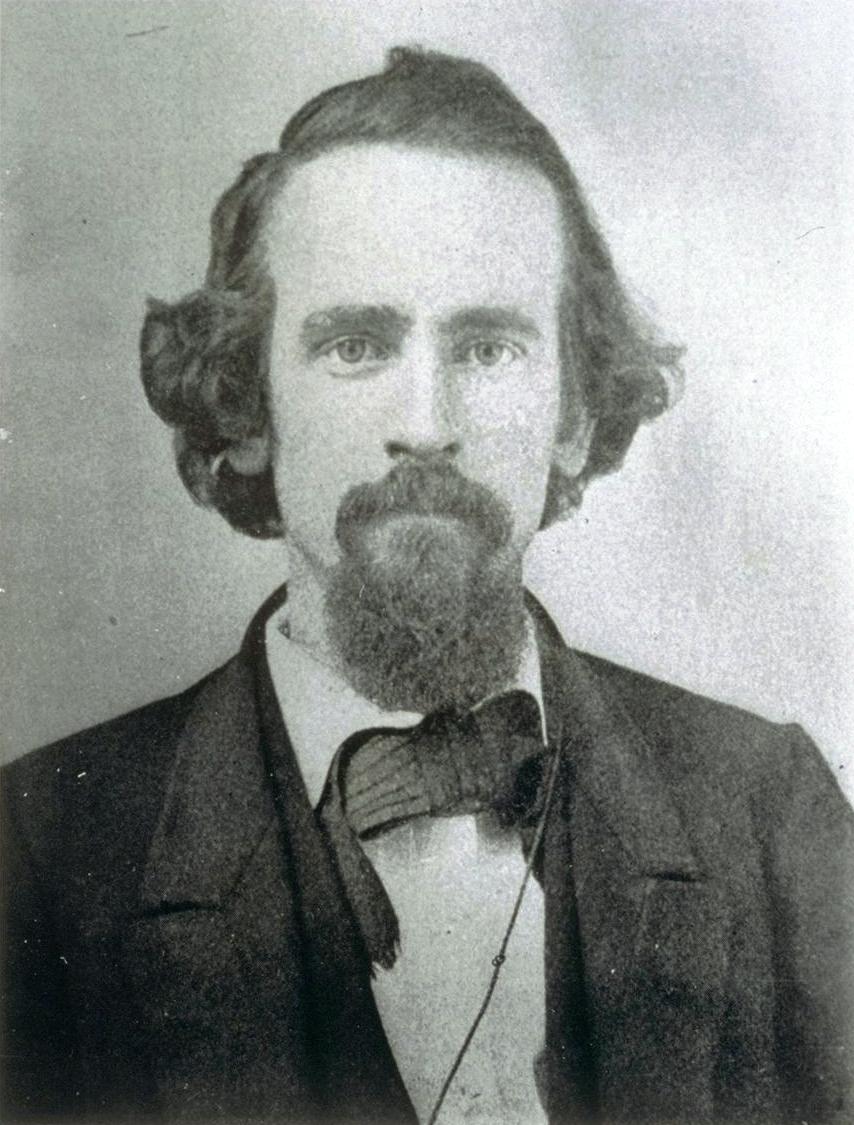

Piero Sraffa

Sraffa's system is different. Sraffa is directly inspired by the system of David Ricardo, with the philosophy and economy of Marx floating ominous and powerful in the background. Instead of concentrating on the balance of subjective demands, he concentrates on a balance of objective supplies. Sraffa's system concentrates on the actual shifts of goods used in the creation of new goods. The actuality of this is both very important - especially if you want to be an historical materialist - and deeply problematic - especially if you want to do economics.

Take the simplest example - a single period of single product industries that produce with no surplus. The total amount of each good at the end of the period will be denoted \( G_j \). The amount of good \( j \) actually used in the production of good \( i \) is denoted \( G_{ji} \). Therefore, we define the distribution matrix \( A \) by \(a_{ij} = \frac{G{ij}}{G_i} \). This matrix is the disaggregated distribution of goods - \(a_{ij}\) is how much of good i is used by industry j. Since there is no surplus, \( A \) is a stochastic matrix, therefore it is easy to see there exists a vector \( p \) such that \( A p = p \). This vector is the system of prices which would allow the system to hold together - at these prices there would be no social force away from the distribution of goods entailed by the distribution matrix.

It is here where Sraffa meets Scylla and Charybdis. What is so special about a self-reproducing economy? Yes, such a price vector can exist, but who cares? What if an industry becomes irrationally depressed and pointlessly produces less one year? Sraffa's system is not based on production functions in the traditional sense - \( A \) is the actual distribution of goods in the system, not the solution to some maximization problem. Sraffa is very proud of this because it lets him sidestep market structure. Sraffa cryptically boasts about this in the introduction of the book. He never explains that this is how he is able to handle increasing returns - because in his system he can't even write them down. Without market structure, Sraffa can't talk about stability or even why \( p \) will be chosen in actuality. His results are written subjunctively, "If the economy is self-reproducing, then...".

In the Wicksteed-Fisher system above, \(a_{ij}\) is the demand for good i by industry j and the price vector \( p \) zeros out excess demand. If one year an industry accidentally underproduces, then it's good's price next year will go up (there will be excess demand). This causes it to be overproduced next year - demand feeds back onto demand. If the system is stable (which may require some amount of intelligent management), eventually the original price vector will be retrieved. It makes sense to work it out temporally.

Now, you might object that Sraffa's system actually is stable, since for any all positive starting price vector \( p^s \), one clearly has \( \lim_{k \to \infty} \frac{A^k p^s}{\| A^k p^s \|} = p \). So if the distribution matrix holds still from time period to time period, the price level will adjust to it. But remember that Sraffa's system is based on the actual distribution of goods. There's no reason to associate \(A^2 p^s\) with two years of production - unless the distribution of goods is fixed by the Gods and the Kings. But why would that be? I'll come back to this point in a bit.

Joseph Schumpeter

This continues to be an issue when Sraffa makes his move at recovering classical political economy. Let's see why. Weaken the assumption that \( A \) is stochastic to merely being non-negative and irreducible. The Perron-Frobenius theorem now gives us the existence of an all positive price vector \( p \) such that \( A p = \lambda p \). Again, this price vector is calculated solely from the actual distribution of goods \( A \). The eigenvalue \( \lambda = \frac{1}{1+R} \), where \( R \) is the maximum level of profit (that is - one where the wage is zero). Another way to think of \( R \) is the amount of surplus in the system. This is an eigenvalue, so it's uniform across industries (not dependent on \( i \) ).

The wage of labor is then related to the actually realized profits \( r \) by the simple equation \(w = 1 - \frac{r}{R}\). In other words, \( \frac{r}{R} \) is the proportion of the surplus going to industry and \( w \) is the proportion going to labor (paid in that standardized unit that Sraffa laboriously constructs). If this is right, then Marx understood the political economic struggle basically correctly. Workers of the world unite - you have nothing to lose but your chains!

... because production doesn't depend on actually realized profits, so you can increase your wages until \( w = \frac{1}{R} \).

But wait - why must the level of profit be uniform? In Sraffa's system, there isn't any industry structure - \( R \) comes out of the matrix of actually distributed goods. But what if right after the distribution of goods \( A \) is measured (though, of course, Sraffa doesn't discuss measurement), an entrepreneur invents a better mousetrap factory. Let's say there are increasing returns and so all the market concentrates under her company. What economic force is equalizing her (long run) rate of profit with everyone else's? In other words, why can we rule out Knight-Schumpeter theories that actually realized profits and industry structure matter for production a priori?

Richard Cantillon

Now, like I said before, Sraffa's book is a Prelude. Not answering these questions is a flaw, but it is a flaw that I think Sraffa would be happy to cop. Classical economics had an answer for these - one that Sraffa leaves carefully in the background. I'll briefly sketch Cantillon's answer as an example. You can read more here, but their notation is sometimes illegible. I'll just use words:

Cantillon was Irish, so let's draw an imaginary Ireland. There are two goods, potatoes and cake. There are two classes of people, royals and laborers. Laborers eat potatoes, royals eat cake. Assume that labor is homogeneous and land is uniform. Wages and rents are therefore uniform - otherwise, just switch to the more profitable sector (in other words: constant returns). Since there are only two goods, one can now solve for equilibrium based on the balance of income flows. The fund for labor for growing cake (that is, the uniform wage times the quantity so employed) must exactly be the total rent received for growing potatoes. Since rent is the same everywhere, this gives us the total rent - which must also be the amount spent on cake. The number of laborers in the economy is a function of the amount of potatoes grown. Hopefully, there is some amount of potatoes that results in a stable population. That ratio decides the amount spent on potatoes the labor supply. Since we know the wages and the labour supply, we know the wages fund. We can then keep working through until we've solved for prices and quantities separately. With Cantillon's assumptions, everything is proportional to the quantity of land with proportionality constant coming from technology.

There are many differences between this argument and Sraffa's argument. In Cantillon's system, there is a clear - albeit slow - equilibrating social force. If "too much" land is given to growing potatoes, population will grow and wages will fall. As a result, landowners will be able to grow lots of cake cheaply until population falls again. If "too much" land is given to growing cake, then the population will be forced down and wages will rise until landowners are forced to change their pattern of land use. God chose the final distribution when he made man an animal.

Sraffa was intensely concerned to not assume uniform land and constant returns - in his system, rent is not uniform across land. He didn't want to spurn his first paper. If land is uniform, all patterns of land use are equally valid. But if land is starkly non-uniform as Sraffa believes (or at least, believes it is important not to rule out a priori), then a pattern of land use consistent with population stability may not even exist (though I have no proof of this). Nowhere in Production Of Commodities By Means Of Commodities does Sraffa even mention determinants of population!

Henry George

Earlier I said that Sraffa's analysis is full of innuendo and carefully laid traps. His discussion of Land Value Tax (LVT) is an example. Because land cannot be produced and therefore isn't in that set of self-reproducing commodities called "basic" by Sraffa, a LVT cannot affect production and therefore is not economic. It falls entirely on the landlord. This result is identical to the usual, "supply and demand" result, though less general (since the supply and demand result holds even if land is mispriced). But it carefully hints at the basic definition of what is and is not an economic result. Sraffa implicitly argues that there is no economic argument against a Land Value Tax because it doesn't affect production - implicitly defining economics in a way that emphasizes production.

Vilfredo Pareto

From the perspective of Pareto, this definition is by its very nature political - it values some people (producers) over others (landowners). You might agree - as I do, on basically utilitarian grounds - with a stiff LVT, but to simply dismiss landowners outright and a priori is a little shocking!

I'm sure that Sraffa could entirely defeat me philosophically, that he had very good arguments that this and not, say, "the optimal use of scarce resources for given ends" is the best way to do political economy. I'm sure he could give a good reason why this and not, say, Rawlsian reasons are the best reasoning behind an LVT. I'm sure he could give a good reason that the resulting distribution would be "just" to any Nozickian objectors (such as James Mill). But he doesn't deploy these reasons openly in Production Of Commodities By Means Of Commodities.

Piero Sraffa

Considered as a foundation of economics, there are many other things lacking in Sraffa's slim book - money, uncertainty, technical progress, etc. - but I can forgive all of these in return for it's flash and fire. I find it very hard to forgive the lack of an equilibrating mechanism.

No comments:

Post a Comment