One can say honestly that the vast majority of learning is linear or nearly so. But there are also points, one might call them "phase transitions", where suddenly progress becomes suddenly easier - or suddenly much harder. I remember reading a story about a jazz musician (I don't care to look up the source so I will not give his name, even though it is Charles Mingus) who was learning to improvise for the first time. It was himself on a cello and his sister with a piano playing a song of his own composition. His part was a single note - a pedal point. Suddenly, at the end of the song he had a break and played notes and notes that had never been written. His mind was empty except for the sound of the notes he played. It was hours of work - not hours but days and weeks - to culminate in what was probably thirty seconds of improv. But it was a phase transition, he was a different being afterward.

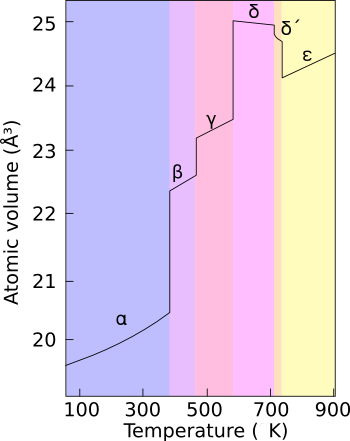

Learning is multidimensional, of course. At some points, altering in one dimension is pointless. In the above graph, one can see that at 1000 K, plutonium will not change phase at any reasonable pressure. Even in common sense you can see that if the temperatures is low enough, ice will not melt or sublimate whatever the pressure is. Moving constantly in the same direction can be a trap.

So it is with learning. After "phase changes" one finds that practice in one sense no longer might help. A beginning artist might learn much from copying other artists - even tracing them. Albert Ayler was called "Little Bird" because he was constantly practicing Charlie Parker solos. He got to know them so well that he could literally play them backwards. This was probably good practice for the young Ayler, but I doubt he was doing it in 1964.

Friedman-Savage Utility

Milton Friedman was originally interested in micro-economics. He, and the great Bayesian Jimmie Savage, tried to solve two economic problems with one stone. They worked together a great deal and wrote this classic paper. First was the question "Why do people buy insurance and lotteries?", the second was related to the distribution of wealth in society. This is a brilliant paper that everyone capable of understanding it should read.

Friedman and Savage proposed that the level of risk tolerance is dependent on wealth in a non-monotonic way. There were to be two inflection points - "phase changes" one might say. The poor would be risk-averse in order to sustain their lives, the wealthy would be risk averse out of lack of need to be otherwise. The middle class would be risk loving, perhaps out of a desire to get up to the upper class. This is only the simplest of possible Friedman-Savage functions, one can drop unlimitedly many phase changes in order to create as lower, upper and even middle income traps as desired.

There is an obvious similarity between this and learning. Wealth is perhaps practice time, Utility perhaps skill. In Silver Screen Fiend, Patton Oswalt describes stand-ups that remained in Virginia, telling the same stale jokes every week. It's a low skill-level trap. They were too risk-averse to take a bet that might make them mediocre - or perhaps even great. George Starosin - as clear eyed about old pop music as any man should want to be - defending, while defining his utility function, the idea that no great band would make a truly bad album. He is defending the idea of a high skill trap - if such a thing is a "trap" (don't the romantics tell us it is the more painful one?).

These are two metaphors for learning. I want to develop the ideas more carefully, maybe make some testable proposals. But it is nice to say it out loud and write it down - even if just as a check against madness...

.png)

No comments:

Post a Comment